BETTER THAN “CROSS OF GOLD”

One of the greatest oratorical battles in Congress concerned starting an income tax in 1894. The tax passed. It was quickly challenged and declared unconstitutional in 1895. This eventually led to passage of the income tax amendment in 1913.

William Jennings Bryan is famous for his “Cross of Gold” speech, given upon accepting the Democratic Party's 1896 presidential nomination, but it pales in comparison to his magnificent 1894 extemporaneous debate on the House floor in favor of an income tax. With a $4,000 exemption, the tax would affect only 85,000 out of a population of 65 million. It was clearly intended to be a tax on the wealthy, with a flat rate of just two percent.

The opposition branded income tax as a plot by communists, socialists and anarchists. Magazine articles with titles like “The Communism of a Discriminating Income Tax” fueled emotions. William Bourke Cockran, the Democrats’ best orator in the House, argued against:

-

You have not attempted to tax the people, but you have attempted to tax the incomes of 85,000 of them. You have undertaken to set aside a class on which alone this tax is to fall, and to degrade the balance of the people to a plane of inferior importance....He who is relieved from taxation, who is exempt from his share in one single burden of government, forfeits to that extent the grounds upon which his right to control the Government is based.

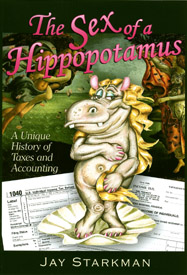

The strange circumstances that led to the Supreme Court's "unconstitutional" ruling, the unusual procedures surrounding passage of the only constitutional amendment ever ratified to overturn a Supreme Court ruling, and the reason that his reading of "My Native Land" evoked such "loud and long-continued applause" can be found in The Sex of a Hippopotamus: A Unique History of Taxes and Accounting.

Income Tax Speech

William Jennings Bryan

January 30, 1894

53-2 Cong. Record (vol. 26) p. 1655

William Jennings Bryan

January 30, 1894

53-2 Cong. Record (vol. 26) p. 1655

MR. BRYAN. Mr. Chairman, if this were a mere contest in oratory, no one would be presumptuous enough to dispute the prize with the distinguished gentlemen from New York [Mr. Cockran]; but clad in the armor of a righteous cause I dare oppose myself to the shafts of his genius, believing that “pebbles of truth” will be more effective than the “javelin of error,” even when hurled by the giant of the Philistines. [Applause.] What is this bill which has brought forth the vehement attack to which we have just listened? It is a bill reported by the Committee of Ways and Means as the complement of the tariff bill. It, together with the tariff measure already considered, provides the necessary revenue for the support of the Government. The point of attack is the income tax, individual and corporation (which is expected to raise about $30,000,000), and to what I will devote the few minutes which are allowed for closing the debate.

The gentlemen from New York insists that sufficient revenue will be raise from the tariff schedules, together with the present internal-revenue taxes, and that it is therefore unnecessary to seek new objects for taxation. In this opinion he is not supported by the other members of the committee, and we have been constrained to follow our own judgment rather than his. The internal-revenue bill which is now pending as an amendment to the tariff bill imposes a tax of 2 per cent upon the net incomes of corporations, and in the case of corporations no exception is allowed.

I need not give all the reasons which led the committee to recommend this tax, but will suggest two of the most important. The stockholder in a corporation limits his liability. When the statute creating the corporation is fully complied with the individual stockholder is secure, except to the extent fixed by the statute, whereas the entire property of the individual is ordinarily liable for his debts. Another reason is that corporations enjoy certain privileges and franchises. Some are given the right of eminent domain, while others, such as street-car companies, are given the right to use the streets of the city — a franchise which increases in value with each passing year. Corporations occupy the time and attention of our Federal courts and enjoy the protection of the Federal Government, and as they do not ordinarily pay taxes the committee felt justified in proposing a light tax upon them.

Some gentlemen have accused the committee of showing hostility to corporations. But, Mr. Chairman, we are not hostile to corporations; we simply believe that these creatures of the law, these fictitious persons, have no higher or dearer right than persons of flesh and blood upon whom God created and placed upon his footstool! [Applause.] The bill also imposes a tax of 2 per cent upon individual incomes in excess of $4,000. We have proposed the maximum of exemption and the minimum of rate. The principal is not new in this country. For nearly 10 years during and after the war, an income tax was levied, varying from 2½ to 10 per cent, while the exemption range from $600 to $2,000. In England the rate for 1892 was a little more than 2 per cent, the amount exempt, $750, with an additional deduction of $600 on incomes of less than $2,000. The tax has been enforced they are in various forms for more than fifty years.

In Prussia the income tax has been in operation for about twenty years; incomes under 900 marks are exempt, and a tax ranges from less than 1 per cent to about 4 per cent, according to the size of the income.

Austria has tried the income tax for thirty years, the exemption being about $113, and the rate ranging from 8 per cent up to 20 per cent.

A large sum is collected from income tax in Italy; only incomes under $77.20 are exempt, and the rate runs up as high as 13 per cent on some incomes.

In the Netherlands the income tax has been in operation since 1823. At present incomes under $260 are exempt, and the rate ranges from 2 per cent to 3½ per cent, the latter rate being paid upon incomes in excess of $3,280.

In Zürich, Switzerland, the income tax has been in operation for more than half a century. Incomes under $100 are exempt, and the rate ranges from about 1 per cent to almost 8 per cent, according to the size of the income.

It will thus be seen that the income tax is no new device, and it will be noticed that the committee has proposed a tax lighter in rate and more liberal in exemption than that imposed in any of the countries named.

PAGE 1655

—

PAGE 1656

If I were consulting my own preference I would rather have a graduated tax, and I believe that such a tax could be defended not only upon principle, but upon grounds of public policy as well; but I gladly accept this bill as offering a more equitable plan for making up the deficit in our revenues than any other each has been proposed. The details of the bill will be discussed to-morrow under the five-minute rule, and any necessary changes can be made.

The committee presents the bill after careful consideration, but will cheerfully accept any changes which the wisdom of the House may suggest. The bill not only exempt from taxation, but from annoyances as well, every person whose income is below $3,500. This is an important feature of the bill. In order to guard against fraud the bill provides that every person having an income more than $3,500 shall make a return under oath, but no taxes collected a less than net income exceeds $4,000. The bill also provides severe penalties to restrain the tax-collector from disclosing any information gained from the returns made by citizens.

OBJECTIONS ANSWERED.

And now, Mr. Chairman, let us consider the objections which have been made. The gentlemen from New York [Mr. Bartlett] who addressed the House this forenoon, spend some time in trying to convince us that, while the Supreme Court had without dissent affirmed the constitutionality of an income tax, yet it might add some future time reverse the decision, and that, therefore, this bill ought to be rejected. This question has been settled beyond controversy. The principle has come before the court on several occasions, and decisions have always sustain the constitutionality of the income tax. (Hylton vs. United States, 3 Dall., 171; Deasie Bank vs. Fenno, 8 Wall, 533; Scholey vs. Rew, 23 Wall., 331; Pacific Insurance Company vs. Soule, 7 Wall., 433.)

In Springer vs. United States (102 United States, 586) the question was directly raised upon the law in enforce from 1863 to 1873 and the court held that the income tax as then collected was not a direct tax within the meaning of the Constitution, and therefore need not be apportioned among the State according to their population.

But gentlemen, we have denounced the income tax as class legislation, because it will affect more people in one section of the country than in another. Because the wealth of the country is to a large extent, centered in certain cities and States does not make a bill sectional which imposes a tax in proportion to wealth. If New York and Massachusetts pay more tax under this law than other States, it will be because they have more taxable incomes within their borders. And why he should not those sections pay most which enjoy most?

The census shows that the population of Massachusetts increased less than half a million between 1880 and 1890, while the assessed value of her property increased more than half a billion during the same period. The population of New York increased about 900,000 between 1880 and 1890, while the assessed value of the property increased more than $1,100,000,000. On the other hand, while the population of Iowa and Kansas combined increased more than 700,000, the assessed valuation increased only a little more than $300,000,000. This bill is not in the line of class legislation, nor can it be regarded as legislation against a sector for the rate of taxation is the same upon every income over $4,000, whether its possessor lives upon the Atlantic coast, in the Mississippi Valley or on the Pacific Slope. I only hope that we may in the future have more farmers in the agricultural districts whose incomes are large enough to tax. [Applause.]

But the gentleman from New York [Mr. Cockran] has denounced as unjust the principle underlying this tax. It is hardly necessary to read authorities to the House. There is no more just tax upon the statute books than the income tax, nor can any tax be proposed which is more equitable; and the principle is sustained by the most distinguished writers on political economy.

Adam Smith says:

-

The subjects of every State wanted to contribute to the support of the Government, as nearly as possible in proportion to their respective abilities; that is, in proportion to the revenue which they respectively enjoyed under the protection of the State. In the observation or neglect of this maxim consists what is called the equality or inequality of taxation.

I read the other day in the New York World — and I gladly join in ascribing praise to that great daily for courageous fight upon this subject in behalf of the common people — a description of the home of the richest woman in the United States. She owns property estimated at $60,000,000, and enjoys an income which can scarcely be less than $3,000,000, yet she lives at a cheap boarding-house, and only spend the few hundred dollars a year. That woman, under your indirect system of taxation, does not pay as much toward the support of the Federal Government, as a laboring man whose income of $500 is spent upon his family. [Applause.]

Why, sir, the gentlemen from New York [Mr. Cockran] said that the poor are opposed to this tax because they do not want to be deprived of participation in it, and that taxation instead of being a sign of servitude is a badge of freedom. If taxation is a badge of freedom, let me assure my friend that the poor people of this country are covered all over with the insignia of freemen. [Applause.]

Notwithstanding the exemption proposed by this bill, the people whose incomes are less than $4,000 will still contribute far more than their just share to the support of the Government. The gentleman says that he opposes this tax in the interest of the poor! Oh, sirs, is it not enough to betray the cause of the poor — must it be done with a kiss? [Applause.]

Would it not be fairer for the gentleman to fling his burnished lance full in the face of the poor toiler, and not plead for the great fortunes of this country under cover of the poor man's name? [Applause.] The gentleman also tells us that the rich will welcome this tax as a means of securing greater power. Let me call your attention to the resolutions passed by the New York Chamber of Commerce. I wonder how many poor men have membership in that body! Here are the resolutions passed at a special meeting called for the purpose. The newspaper account says:

-

Resolutions were adopted declaring “the proposal to impose an income tax is unwise, unpolitic, and unjust for the following reasons:

“First. Experience during our late war demonstrated that an income tax was inquisitorial and odious to our people, and only tolerated as a war measure, and was abrogated by universal consent as soon as the condition of the country permitted.

“Second. Experience has also shown that is expensive to put in operation; that it can not be fairly collected, and is an unjust distribution of the burdens of taxation and promotes evasions of the law.

“Third. The proposal to exempt incomes under $4,000 is purely class legislation, which is socialistic and vicious in its tendency, and contrary to the traditions and principles of republican government.”

Still another resolution was adopted declaring “that in addition to an internal-revenue tax the necessary expenses of the Government should be collected through the custom-house, and that the Senators and Representatives in Congress from the State of New York be requested to strenuously oppose all attempts to reimpose an income tax upon the people of this country.”

Mr. PATTERSON. And by ROGER Q. MILLS.

Mr. BRYAN. Yes, by ROGER Q. MILLS, I am informed, and a host of others. Not only did the Senators mentioned oppose repeal, but they spoke with emphasis in favor of the justice of an income tax.

Senator SHERMAN said:

-

The Senator from New York and the Senator from Massachusetts have led off in declaring against the income tax. They have declared it to be invidious. Well, sir, all taxes are invidious. They say it is inquisitorial. Well, sir; there never was a tax in the world that was not inquisitorial.

* * *

The least inquisitorial of all is the income tax.

* * *

I hope that after full discussion nobody will vote for striking out the income tax. It seems to me to be one of the plainest propositions in the world. Put before the people of the United States the question whether the property of this country can not stand a tax of $20,000,000, when the consumption of the people stands a tax of $300,000,000, and I think they will quickly answer it. The property-holders of the country came here and demanded the repeal of the only tax that bears upon their property, when we

—

PAGE 1657

-

have to tax everything for the food of the poor, the clothing of the poor, and all classes of our people $300,000,000.

There never was so just a tax levied as the income tax.

There is no objection that can be urged against the income tax that I can not point to it in every tax.

Writers on political economy, as well as our own sentiments of what is just and right, teach us that a man ought to pay taxes according to his income and in no other way.

Senator Howe said:

-

There is not a tax on the books so little felt, so absolutely unfelt in the payment of it, as this income tax by the possessors of the great fortunes upon which it falls.

There is not a man in this country, not a laborer in this country but what contributes more than 3, more than 10, more than 20 per cent of all his earnings to the Treasury of the United States under those very laws against which I am objecting; and now we are invited to increase their contributions, and to release these trifling contributions which we have been receiving from incomes heretofore.

-

The State taxation in Indiana, and I undertake to say of every State in the Union, as in it every inquisitorial feature that the income tax has.

The income tax is of all others the most equitable because it is the truest measure that has yet been found of the productive property of the country.

IS IT INQUISITORIAL?

The gentleman from New York says that this tax is inquisitorial, that it pries into a man's private business. I sent to New York and obtained from the city chamberlain copies of assessment blanks used. The chamberlain writes:

-

The matter of assessing personal taxes is arrived at by interrogation of the persons assessed by either of the commissioners, which is a very rigorous cross-examination in reference to the amount of personal property they have, and reductions are only made by an affidavit asking for the same and sworn to before a tax commissioner of this county.

-

the full value of all property, exclusive of said bank shares owned by deponent (and not exempt by law from taxation) on the second Monday in January, 189–, did not exceed $——; that the just debts owing by the deponent on said they amounted to $——, and that no portion of such debts has been deducted from the assessment of any personal property of the deponent, other than said bank shares, or has been used as an offset in the adjustment of any assessment for personal property whether in this or any other county or State, for the year 189–, or incurred in the purchase of nontaxable property or securities, or for the purpose of evading taxation.

In Connecticut the citizen is required to give the number and value of various domestic animals, the number of watches, the value of jewelry, household furniture, library, etc.; also bonds, stocks, money at interest, and money on deposit. Is the proposed tax any more inquisitorial than that?

In Nebraska this citizen is compelled to give the number and value of all domestic animals, watches, diamonds, jewelry, money, credits, etc., and what is true in Nebraska is true generally of all the States. Is an income tax more inquisitorial than these taxes upon personal property? I insist, sirs, that the income tax provided for in this bill is less inquisitorial in its nature that the taxes which are found in every State in the Union.

But they say that the income tax invites perjury; that the man who has a large income will swear falsely, and thus avoid the payment of the tax; and, indeed, the gentleman from Massachusetts [Mr. WALKER] admitted that his district was full of such people, and he said that our districts were, too. I suppose these constituents whom he accuses of perjury are expected to pat him on the back when he goes home and brag about the complement he paid them. [Laughter and applause.]

If there is a man in my district whose veracity is not worth 2 cents on the dollar, who will perjure himself to avoid the payment of a just tax imposed by law, I am going to wait until he pleads guilty before I make that charge against them. [Laughter and applause.]

They say that we must be careful and not invite perjury. Why, sirs, this Government has too much important business on hand to spend its time trying to bolster up the morality of men who cannot be trusted to swear to their incomes. And let me suggest that gentlemen who come to this House and tell us that their districts are full of such persons are treading upon dangerous ground. If a man will hold up his hand to Heaven and perjure his soul to avoid a 2 per cent tax due to his Government, how can you trust such a man when he goes into court and testifies in a case in which he has a personal interest?

If your districts are full of such perjurers, if your districts are full of men who violate with impunity not only the laws but their oaths, do you not raise a question as to the honesty of the methods by which they have accumulated their fortunes? [Applause on the Democratic side.] Instead of abandoning just measures for fear somebody will perjure himself, let them be enacted into law, and then if anyone perjures himself we can treat him like any other felon, and punish him for his perjury. [Applause.]

But, gentlemen say that some people will avoid the tax, and that therefore it is unfair to the people who pay. What law is fully obeyed? Why are criminal courts established, except to punish people who violate the laws which society has made? The man who pays his tax need not concern himself about the man who avoids it, unless perhaps he is willing to help prosecute the delinquent. The man who makes an honest return and complies with the law, pays no more than the rate prescribed, and if the possessors of large fortunes escape by fraud the payment of one-half their income tax, they will still contribute far more than they do now to support the Federal Government, and to that extent relieve from burdens those who now pay more than their share.

The gentleman from New York is especially indignant because incomes under $4,000 are exempt. Why, sir, this is not a new principle in legislation. The exemption of a very small incomes might be justified on the ground that the cost of collection would exceed the amount collected, but it is not necessary to urge this defense. The propriety of making certain exemptions is everywhere recognized. So far as I have been able to investigate, every country which now imposes or has imposed an income tax has exempted small incomes from taxation. Nearly if not all of our States exempt certain kinds of property, or property to a certain amount. If an exemption tends toward socialism, as urged by the gentleman from New York [Mr. COCKRAN] and the Chamber of Commerce, is it possible that socialism has taken possession of the States of New York and Connecticut?

I find in the assessment blank used in New York the words “and not exempt by law from taxation,” indicating that some property is exempt. The gentleman from New York had better eradicate this evidence of socialism, as he calls it, from the statutes of his own State before he denounces us for following the example set by New York.

I find from the Connecticut assessment blank that farming utensils to the value of $200, mechanics’ tools to the value of $200, watches and jewelry to the value of $25, musical instruments to the value of $25, household furniture to the value of $500, libraries to the value of $200, and money on deposit to the amount of $100 are all exempt from the personal property tax. What a firm hold socialism seems to have gained upon Connecticut!

The gentlemen who are so fearful of socialism when the poor are exempted from an income tax view with indifference those methods of taxation which give the rich a substantial exemption. They weep more because fifteen millions are to be collected from the incomes of the rich than they do at the collection of three hundred millions upon the goods which the poor consume. And when an attempt is made to equalize these burdens, not fully, but partially only, the people of the South and West are called anarchists.

I deny the accusations, sirs. It is among the people of the South and West, on the prairies and in the mountains, that you find the staunchest supporters of government and the best friends of law and order.

You may not find among these people the great fortunes which are accumulated in cities, nor will you find the dark shadows which these fortunes throw over the community, but you will find those willing to protect the rights of property, even while they demand that property shall bear its share of taxation. You may not find among them so much of wealth, but you will find men who are not only willing to pay their taxes to support the Government, but are willing whenever necessary to offer up their lives in its defense.

These people, sir, whom you call anarchists because they ask that the burdens of government shall be equally borne, these people have ever borne the cross on Cavalry and saved their country with their blood.

Mr. George K. Holmes, of the Census Department, in an article recently published in the Political Science Quarterly, gives some tables showing the unequal distribution of property, and says:

-

Otherwise stated, 91 per cent of the 12,690,152 families of the country own no more than about 29 per cent of the wealth, and 9 per cent of the families own about 71 per cent of the wealth.

PAGE 1657

—

PAGE 1658

where it could be reached by an enemy's guns? Who demands a standing army? Is it the poor man as he goes about his work, or is it the capitalist who wants that army to supplement the local government in protecting his property when he enters into a contest with his employees? For whom are the great expenses of the Federal Government incurred? Why, sir, when we ask that this small pittance shall be contributed to the expenses of the Federal Government, we are asking less than is just rather than more. But the gentleman from New York fears that this amendment will embarrass the bill, and denounces the action of the caucus as treason.

It has never been the policy of the party to control the member's vote upon the merits of a question by a caucus, and the caucus recently held was not to determine how anyone should vote, but simply to decide whether the internal-revenue bill should be attached the tariff bill or brought up subsequently as an independent measure. When a member comes to represent a constituency upon this floor, he is responsible to his conscience and to his constituency, and to them alone. But gentlemen will remember that no revenue bill exactly meets the wishes of any one member, and that we are continually compelled to choose between something not wholly desirable and something else less desirable still.

Individual Democrats have opposed various tariff schedules, and have opposed them honestly; but the House, in Committee of the Whole, has agreed upon a certain tariff policy, and the tariff bill as agreed upon leaves a deficit in the revenue. This deficit must be made up, and it must be made up in that way which is most agreeable to a majority of the House. If the pending amendment providing for the income tax is adopted by the House, it then becomes a part of the bill, and upon the final vote we shall be called upon to choose between the present law and a tariff-reform measure embodying an income tax. Each one must decide his course for himself.

If any Democrat who has advocated tariff reform and denounced the present law is willing to go back to his people and say, “Yes, the McKinley tariff is a crime; its loads are heavy and its oppression great, but I choose to make you bear the injustice still rather than bring you a relief accompanied by a light tax upon incomes,” he can settle the matter with those whom he represents. If there be those who are willing to see their fellows oppressed “with burdens grievous to be borne,” and yet “touch not the burdens” lest wealth may be displeased, the rest of us can still carry on the work of tariff reform, even if in so doing we must impose a tax which embodies the just principle observed by Him who “tempers the wind to the shorn lamb.”

And, Mr. Chairman, I desired to here enter my protest against the false political economy taught by our opponents in this debate and against the perversion of language which we have witnessed. They tell us that it is better to consider expediency than equity in the adjustment of taxation. They tell us that it is right to tax consumption, and thus make the needy pay out of all proportion to their means, but that it is wrong to make a slight compensation for this system by exempting small incomes from an income tax. They tell us that it is wise to limit the use of the necessaries of life by heavy indirect taxation, but that it is vicious to lessen the enjoyment of the luxuries of life by a light tax upon large incomes. They tell us that those who make the load heaviest upon persons least able to bear it are distributing the burdens of government with an impartial hand, but that those who insist that each citizen should contribute to government in proportion as God has prospered him are blinded by prejudice against the rich. They call that man a statesman whose ear is tuned to catch the slightest pulsations of a pocketbook, and denounce as demagogue anyone who dares to listen to the heart-beat of humanity. [Applause.]

Let me refer again in conclusion, to the statement made by the gentleman from New York [Mr. Cockran], that the rich people of his city favor the income tax. In a letter which appeared in the New York World on the 7th of this month, Ward McAllister, the leader of the “Four Hundred,” enters a very emphatic protest against the income tax. [Derisive laughter.] Here is an extract:

-

In New York City and Brooklyn the local taxation is ridiculously high, in spite of the virtuous protest to the contrary by the officials in authority. Add to this high local taxation and income tax of 2 per cent on every income exceeding $4,000, and many of our best people will be driven out of the country. An impression seems to exist in the minds of our great Democratic Solons in Congress that a rich man would give up all his wealth for the privilege of living in this country. A very short period of income taxation would show with these gentlemen their mistake. The custom is growing from year to year for rich men to go abroad and live, where expenses for the necessaries and luxuries of life are not nearly so high as they are in this country. The United States, in spite of their much boasted natural resources, could not maintain such a strain for any considerable length of time.

But whither will these people fly? If their tastes are English, “quite English, you know,” and they stopped in London, they will find a tax of more than 2 per cent assessed upon incomes; if they look for a place of refuge in Prussia, they will find an income tax of 4 per cent; if they search for seclusion among the mountains of Switzerland, they will find an income tax of 8 per cent; if they seek repose under the sunny skies of Italy, they will find an income tax of more than 12 per cent; if they take up their abode in Austria, they will find a tax of 20 per cent. I repeat, Whither will they fly? [Applause.]

Mr. WEADOCK. The gentleman will allow me to suggest that at Monte Carlo such a man would not have to pay any tax at all. [Laughter.]

Mr. BRYAN. Then, Mr. Chairman, I presume to Monte Carlo he would go, and that there he would give up to the wheel of fortune all the wealth of which he would not give a part to support the Government which enabled him to accumulate it. [Laughter and applause.]

Are there really any such people in this country? Of all the mean men I have ever known, I have never known one so mean that I would be willing to say of him that his patriotism was less than 2 per cent deep. [Laughter and applause.]

There is not a man whom I would charge with being willing to expatriate himself rather than contribute from his abundance to the support of the Government that protects him.

If “some of our best people” prefer to leave the country rather than pay a tax of 2 per cent, God pity the worst. [Laughter.]

If we have people who value free government so little that they prefer to live under monarchical institutions, even without an income tax, rather than live under the stars and stripes and pay a 2 per cent tax, we can better afford to lose them and their fortunes than risk the contaminating influence of their presence. [Applause.]

I will not attempt to characterize such persons. If Mr. McAllister is a true prophet, if we are to lose some of our “best people” by the imposition of an income tax, let them depart, and as they leave without regret the land of their birth, let them go with the poet's curse ringing in their ears:

-

Breathes there the man, with soul so dead,

Who never to himself hath said,

This is my own, my NATIVE LAND!

Whose heart hath ne’er within him burned,

As home his footsteps he hath turned

From wandering on a foreign strand?

If such there breathe, go, mark him well;

For him no Minstrel raptures swell;

High though his titles, proud his name,

Boundless his wealth as wish can claim;

Despite those titles, power, and pelf,

The wretch, concentred all in self,

Living, shall forfeit fair renown,

And, doubly dying, shall go down

To the vile dust, from whence he sprung,

Unwept, unhonour’d, and unsung.