The FairTax and The Sales Tax Rebellion of 1932

During the Great Depression, there was a desperate need for revenue. In 1932, President Herbert Hoover and leaders of both houses of Congress tried to pass a 2.25 percent national sales tax on everything except food and cheaper clothing. The tax was opposed by the American Federation of Labor, four farm groups, retailers and wholesalers. There were mass meetings throughout the country to protest against the tax. Rank and file members of Congress overwhelmingly defeated it.

How sentiments do change, as today, seventy-five years later, there are demonstrations supporting "The FairTax." This is a 2003 proposal by Congressman John Linder (R-GA) which claims that a 30 percent national sales tax [23% according to supporters. Though a $100 item with 30% sales tax costs $130, that's 23% "tax inclusive:" $130-($130 x 23%) = $100. Thus $30 tax added to a $100 purchase is a 23% tax!] could replace income, payroll, estate and gift taxes. Linder and syndicated talk show host, Neal Boortz, wrote The FairTax Book: Saying Goodbye to the Income Tax and the IRS which became a bestseller. This could be especially onerous when piling a 30% federal sales tax on top of state sales taxes. National sales tax proposals were resoundingly defeated in 1932 and 1942 to allow states exclusive dominion and because they were considered regressive.

Click here to read Jay Starkman's opinion about The FairTax. And below is Neal

Boortz' thoughts on Jay's opinion.

Click here to read Jay Starkman's opinion about The FairTax. And below is Neal

Boortz' thoughts on Jay's opinion.

Please click here if your PC is missing the plugin. [Who is Neal Boortz? Someone recently answered, "You're better off not knowing who he is. Count your blessings and walk away."]

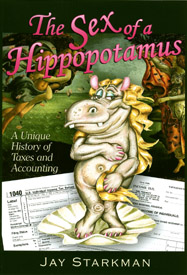

There's more on the Sales Tax Revolt of 1932, The FairTax, The Committee for Constitutional Government (which got almost half the states onboard for a constitutional amendment placing a 25% cap on income tax), and the roles played by New York Mayor Fiorello LaGuardia, President Franklin Roosevelt, House Speaker "Cactus Jack" Garner, and much more in: