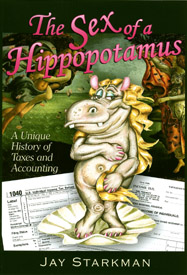

456 pages, $28.95

Where to Buy |

Atlanta Bookstores

Judaica Corner

2185 Briarcliff Rd.

Atlanta, GA 30329

(404) 636-2473

Blue Elephant Bookshop

2091 N. Decatur Road

Decatur, GA 30333

(404) 728-8958

Tall Tales

2105 Lavista Rd., #108

Atlanta, GA 30329

(404) 636-2498

Chosen Treasures

175 Mount Vernon Hwy

Sandy Springs, GA 30328

(404) 843-1933

|

|

Chapters |

Preface Preface

One One

accountants portrayed in popular culture

Two Two

death from overwork

Three Three

accountants' glamorous world

Four Four

history of accounting

"Sarbanes-Oxley Blues," words and music written by Headwaters Co-Founder & Chairman Dave Maney

Five Five

evil taxers

Six Six

U.S. tax history

Seven Seven

IRS history

Eight Eight

Al Capone, FDR, LBJ, MLK, Watergate

Nine Nine

Sex of a Hippopotamus

Ten Ten

Tax Court

Eleven Eleven

tax return publicity

Twelve Twelve

famous wealthy people

Notes Notes

Index Index

|

|

Your First Book

What tax situation have Jimmy Carter, Laura Bush, Barack Obama, Hillary and Bill Clinton in common? They all paid self-employment (SE) tax on their first book, perhaps unnecessarily.

IRS' longstanding position is that "if an individual writes only one book as a sideline and never revises it, he would not be considered to be 'regularly engaged' in an occupation or profession and his royalties therefrom would not be considered net earnings from self-employment." Even when the book is revised, the Tax Court has held that only the royalties from the revised edition are subject to SE tax.

The IRS position does not appear to be well known. Jimmy Carter paid self-employment tax on his first book, Why Not the Best? published in 1976. Hillary Clinton dedicated all earnings - over $1 million in total - from her 1994 first book, It Takes a Village, to charity. She paid tens of thousands of dollars of avoidable self-employment tax on the book royalties. Bill Clinton paid SE tax on his 2004 first book, My Life. as did First Lady Laura Bush on her 2008 first book, Read All About It! Barack Obama's 1995 first book, Dreams of My Fathers was republished in 2007, and he paid SE tax on it. Obama also paid SE tax on his second book, The Audacity of Hope, published in 2006. (All data are from publicly released tax returns, available at Tax History Project: Presidential Tax Returns.)

Although Obama has written two books, an argument can be made that his second book, written eleven years after the first, should also be exempt from SE tax because an 11-year gap shows that he is not "regularly engaged" in book writing. That may not be a position that a president is prepared to take, but might be considered by lower-profile writers.

These returns were all prepared by different CPAs. There may be good reason that SE tax was paid. However, given the existence of favorable revenue rulings and a favorable Tax Court opinion, one would think avoidance of SE tax on the first book which these celebrities wrote would meet a very high standard for a tax return position.

The statute of limitations is still open on some of these returns. Perhaps the return preparers will consider filing amended returns claiming SE tax refunds. And if you as a preparer had a client remit SE tax on royalties from a first book, consider applying for a refund.

You'll find more revelations, and the IRS sources for the position expressed in this article in:

|

|